Ocean State taxpayers will pay Johnston $1.5 million to help cover a small portion of the tax burden Amazon won’t be paying.

Following the Johnston Town Council’s unanimous approval of a Tax Stabilization Agreement (TSA) with the online mega-retailer, in which the company will pay around 60 percent of its tax obligation over the next two decades, the town qualified for Rhode Island’s Tax Stabilization Incentive (TSI) program.

On Monday night, the Rhode Island Commerce Corporation Board of Directors met and voted unanimously to approve a $1.5 million reimbursement for Johnston.

“The town will never turn down any money on the table,” Town Council Vice President Joseph Polisena Jr. said Monday morning. “I’m in support of any policy that would help alleviate the burden of Johnston taxpayers.”

About halfway through the meeting, Jeff Miller, executive vice president of investments for the Rhode Island Commerce Corporation, took a seat at the head table next to Commerce Secretary Stefan Pryor and Rhode Island Gov. Dan Mckee, who serves as chairman of the board.

“This request before you is for a Tax Stabilization Incentive,” Miller told the board. “You may recall that three times before this board has approved a TSI. The notion here is that the state helps to round out a transaction by supporting a town that undertakes a Tax Stabilization Agreement in accordance with its own policies.”

The Tax Stabilization Incentive (TSI) program provides an incentive for Rhode Island municipalities to enter into TSAs by enabling the reimbursement of up to 10 percent of “tax revenue foregone due to the completion of a TSA that spans at least 12 years,” according to state law.

The $1.5 million will cover less than 2 percent of Johnston’s “tax revenue foregone,” according to a member of the Commerce Corporation’s Board of Directors.

“The [TSA] allows for a predictable tax rate and amount for an incoming project sponsor or end-user,” Miller explained. “The town of Johnston did enact, now a couple weeks ago, a TSA, and we are supporting with the amount of $1.5 million that TSA through this Tax Stabilization Incentive.”

In order to qualify for the TSI reimbursement, a community must have a signed tax stabilization agreement with a company that will create at least 50 new full-time jobs, and the developer must commit a capital investment of at least $10 million toward project cost.

“The $1.5 million will essentially ensure the stability of the tax streams received by the town,” Miller said. “It will smooth out some of the tax payments, and ensure relatively predictable payments to the town under its own TSA structure.”

Work may soon begin at the site off Hartford Avenue, near the intersection with Interstate 295.

“The company has predicted to the governor that it may … break ground as soon as the next couple months,” Miller said. “So if all goes well they will be moving swiftly to get into the ground.”

The tax agreement with the town dictates Amazon will be required to make a series of 20 annual tax payments averaging more than $7.2 million each year for the next two decades.

The company will pay $5.7 million the first year, with a fixed annual 2.5 percent increase, raising the annual payment to more than $9 million by the 20th year.

“This is not a last-mile facility,” Miller said. “This is not an Amazon distribution center that will simply deliver to Rhode Islanders, while that’s quite important. This is actually a national asset.”

Amazon will save significantly by avoiding taxation of its tangible assets.

“A project you have probably heard of … we are very pleased that Amazon, a company with many choices as to facilities of this scale, has chosen Rhode Island,” Miller said. “The project that will be produced in Johnston is a 3.8 million square foot complex that we believe will be the largest single facility in Rhode Island, when all is said and done.”

An estimated price tag for construction of the six-story, 3,864,972-square-foot “new, state-of-the-art Amazon Robotics Sortable Fulfillment Center” hovers around $290 million.

Prior to the public hearing where the Town Council ultimately approved the TSA, Polisena Jr. asked Johnston’s legal counsel to estimate the amount of money Amazon will save with the agreement in place.

“Just spoke with the solicitor,” Polisena Jr. wrote via text message several weeks ago. “He believes based on rough estimates they’ll be paying around 60% of their total obligation.”

Amazon will make the stabilized annual payments “in lieu of any and all other real and personal property taxes and assessments,” according to the tax agreement.

“The project will yield $146 million to the town over 20 years in the way of local tax revenue,” Miller said. “Amazon’s also providing a Community Partnership Agreement within which there will be benefits both to the town, and for that matter, to the state. In the case of the town, its public spaces and public programs … a variety of such investments across the town.”

Amazon estimates it will hire 1,350 full-time associates, starting at $18 hourly wages, plus healthcare, dental and 401K benefits.

The company also estimates it will hire 150 managerial, technical and operational oversight jobs with estimated $60,000 annual managerial salaries.

“The company has expressed that it will employ 1,500 people in the construction period … construction labor,” Miller told the board. “And an equal number, 1,500 going forward on a permanent basis. There are reasonable doses of speculation around that number, meaning there are those who think it’s very conservative; it will be a bigger number.”

The new employees’ compensation should total around $57,000,000 in “new annual payroll created.”

In all, Johnston expects to receive more than $170 million in tax dollars and additional benefits over two decades from the proposed Amazon facility.

“The (CPA) also includes state benefits, and among these there are investments in education and training, and there are investments in small business lending, including the Small Business Assistance Program, SBAP, that is administered by this Commerce Corporation,” Miller said. “So we’re very pleased about those benefits.”

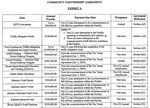

Over the 20-year life of the tax agreement, Amazon will contribute $582,500 annually toward funding a “Johnston High School Pathway Program, including, but not limited to a P-Tech career pathway program for Johnston High School students,” according to the signed agreement.

P-Tech refers to Pathways in Technology Early College High School. Amazon will also make a $400,000 one-time payment to cover the program’s initiation costs.

The company has also pledged to make five annual payments of $250,000 (totaling $1,250,000) toward Rhode Island Municipal Education and Training Initiatives.

“All of this was negotiated very ably by [Johnston] Mayor [Joseph M.] Polisena, who really has done a phenomenal job in partnering with Gov. McKee, and Gov. McKee, I think it was during the transition … has been involved with this prospective transaction that was still only a hoped-for project when the lieutenant governor was entering the governor’s seat,” Miller said. “And of course there’s a very close relationship between the governor and the mayor, and they very effectively navigated this.”

Mayor Polisena did not return a call for comment.

“We were very grateful that both the governor and the mayor were at the council hearing in Johnston where this proposal was approved, with the TSI as a hoped-for ingredient,” Miller told the board. “But that’s pending, of course … the approval of this board, as it always would be, for final enactment. So this item has been reviewed by the Investment Committee as well.”

The board voted unanimously to approve the TSI, granting Johnston $1.5 million.

1 comment on this item Please log in to comment by clicking here

davidbaldwin1

Without detracting at all from the excellent and thorough reporting by Rory Schuler, I cannot help but draw attention to the fact that throughout the entire story, and apparently throughout all of the conversations and negotiations and agreements being reported on, nowhere is it possible to put a finger on one very significant number: the actual net dollar amount of tax revenue that will not be paid by Amazon over the next twenty years. To say "they'll be paying about 60% of their total obligation" or "the project will yield $146 million to the town over 20 years" obscures a crucial side of the equation. It's like asking a car salesperson "How much does it cost?" and getting the answer "You will save a ton of money on gas!" Going forward, it would be helpful if this actual number were reported as thoroughly and as often as the other numbers cited, just to provide a point of reference against which to evaluate the advertised benefits of the deal.

Friday, October 8, 2021 Report this